ECOWAS Kicks Off Workshop in Sierra Leone to Strengthen Tax Policy in Anglophone Member States.

By Raymond Enoch

In a significant land mark step towards fostering tax reform across West Africa, a regional workshop focusing on the Enhancing Capacity for Effective Implementation of the ECOWAS-Adopted Methodology on Tax Expenditure has begun in Freetown, Sierra Leone from the 24th 27th March, 2025

The workshop which aim bolstering the capacity of Anglophone ECOWAS member states to implement improved tax expenditure policies, with an emphasis on harmonizing methods and strengthening governance mechanisms in the tax sector.

Organized by the Directorate of Customs Union and Taxation in partnership with the World Bank, the workshop brings together key stakeholders, including representatives from Ministries of Finance and Tax Administrations across the region. These professionals are united in a common goal to enhance their ability to formulate and implement effective tax policies.

In his opening remarks and address of welcome, Mr. Idrissa Kanu, Director of Tax Revenue and Tax Policy at Sierra Leone’s Ministry of Finance, extended the government’s gratitude to the ECOWAS Commission for its continuous support of tax reforms. He underscored the importance of harmonizing estimation methods and improving tax expenditure governance for long-term economic growth and regional integration.

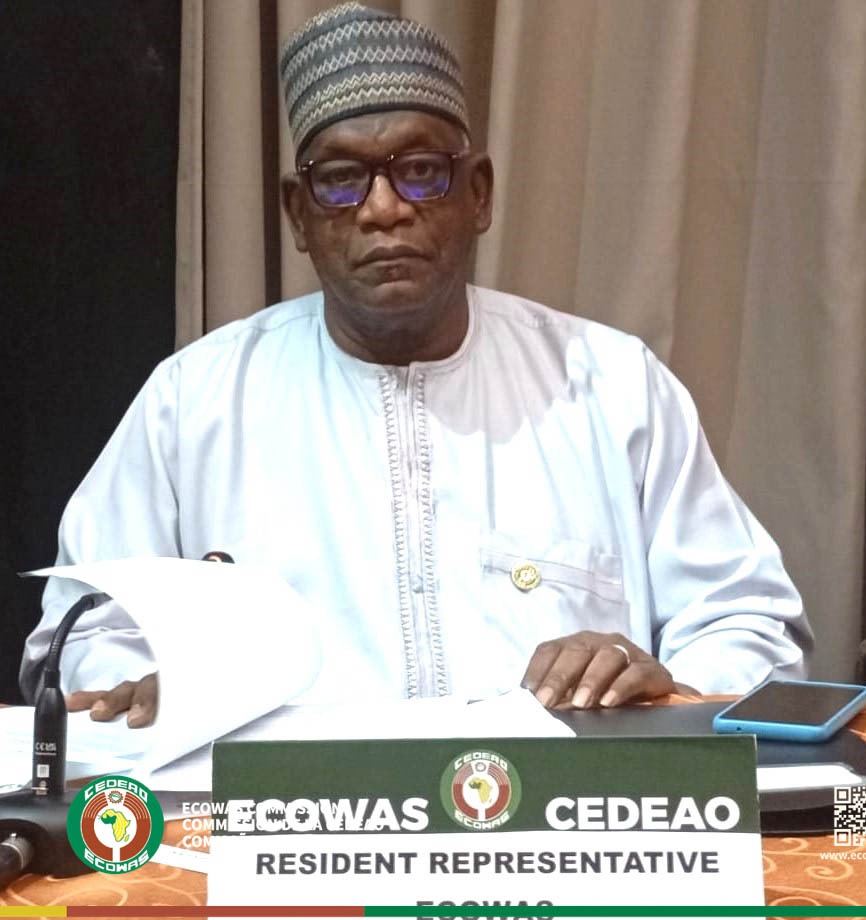

The Resident Representative of ECOWAS in Sierra Leone, H.E. Ambassador Harouna Moussa, declared the workshop open on behalf of the ECOWAS Commission President, H.E. Dr. Omar Alieu Touray.

In his address, Ambassador Moussa highlighted the workshop’s goal of equipping member states with the necessary technical knowledge and tools for applying the ECOWAS-adopted methodology on tax expenditure. He stressed the importance of empowering tax officers to prepare and report tax expenditures effectively, in line with established guidelines, as part of ongoing efforts to promote fiscal discipline and transparency across the region.

This workshop is expected to be a turning point in enhancing regional cooperation and ensuring that tax policies are not only aligned with international best practices but are also tailored to the specific needs of the ECOWAS region. By improving tax expenditure governance, member states can lay the foundation for stronger, more resilient economies that contribute to the broader goals of regional integration and sustainable development.

As the workshop progresses, participants are set to engage in technical discussions, share insights, and receive practical training on the methodologies for tax expenditure management. The outcomes are expected to have a lasting impact on improving the quality of tax policy and administration in the region, fostering economic stability, and ensuring a more equitable distribution of resources.

The ECOWAS Commission’s dedication to fostering effective tax administration is a vital part of its broader mission to drive regional development and integration. With such initiatives, the ECOWAS region is poised to make significant strides in creating a more robust and transparent fiscal environment for the benefit of all member states.

As this workshop continues in the next few days, it will surely play a crucial role in shaping the future of tax policy and governance in West Africa.