ECOWAS Builds Capacity of Member States to implement Regional Tax Reforms.

By Raymond Enoch

In a bold step to bolster regional tax Reforms for enhanced economic growth, the ECOWAS Commission has conducted a four-day workshop aimed at strengthening the capacity of Member States to implement critical tax reforms.

The workshop, titled “Enhancing Capacity for Effective Implementation of the ECOWAS Adopted Methodology on Tax Expenditure,” took place from March 24–27, 2025, in collaboration with the World Bank.

The workshop, held in Sierra Leone, brought together finance and tax administration representatives from across West Africa, focusing on fostering knowledge-sharing and collaboration to improve tax policy formulation and implementation. It was designed to enhance technical knowledge on tax expenditure management, a key area in maximizing tax revenues and promoting economic growth in the region.

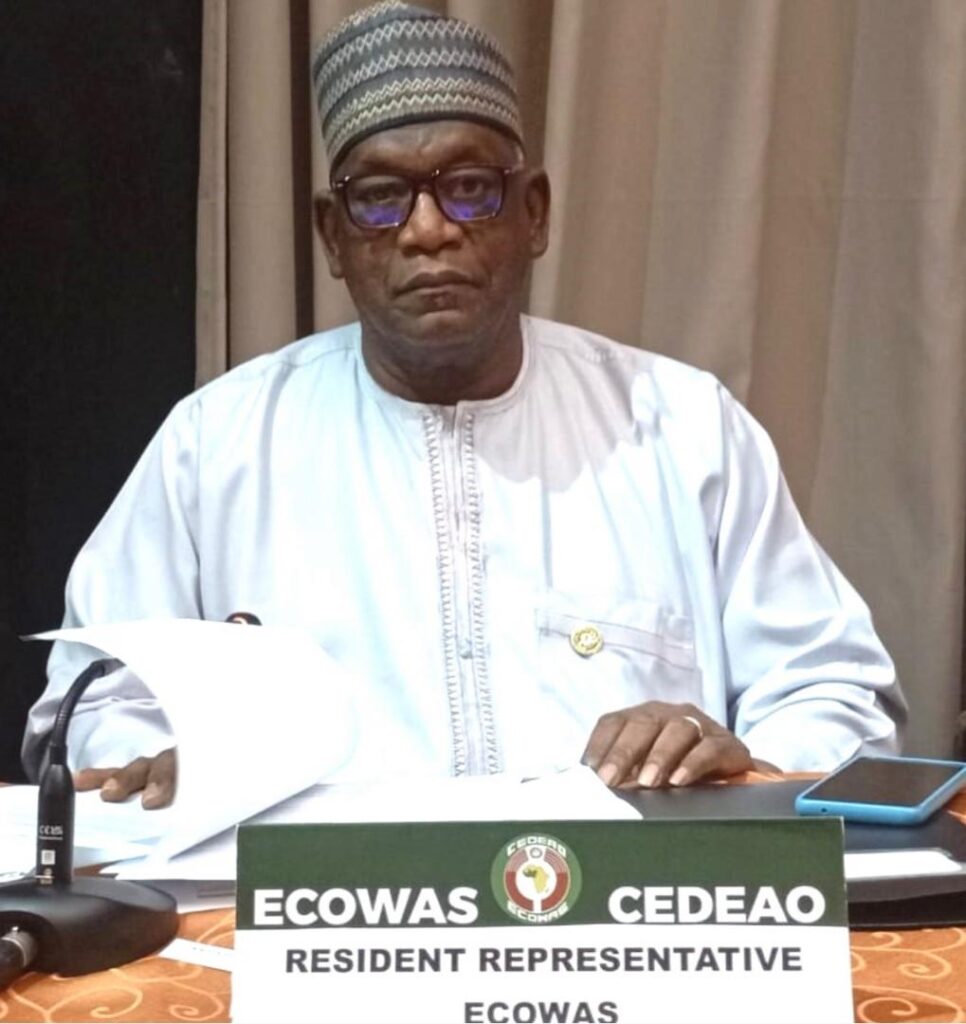

Speaking on behalf of ECOWAS Commission President, H.E. Dr. Omar Alieu Touray, the Resident Representative of ECOWAS in Sierra Leone, H.E. Ambassador Harouna Moussa, emphasized the importance of aligning ECOWAS’ tax expenditure policies with international standards. “This workshop is critical in ensuring that tax policies within ECOWAS Member States are harmonized, transparent, and aligned with regional economic goals,” Moussa stated. He also highlighted the potential for the reforms to significantly improve government revenues, if tax expenditures are properly managed.

Mr. Idrissa Kanu, Director of Tax Revenue and Tax Policy at Sierra Leone’s Ministry of Finance, echoed similar sentiments, stressing the importance of harmonizing tax practices within ECOWAS to ensure greater tax compliance and revenue generation. “This initiative will ultimately contribute to broadening the tax base and increasing revenue in the most efficient and equitable manner,” Kanu said, noting that these reforms are vital to the region’s economic future.

World Bank Senior Economist Alastair Thomas underscored the importance of these reforms, stating that the World Bank is committed to supporting ECOWAS in enhancing the capacity of its Member States. “The World Bank is delighted to collaborate with ECOWAS in enhancing tax expenditure governance in West Africa. This initiative will not only improve transparency and accountability but will also facilitate data-driven decisions,” Thomas said.

The workshop also featured expert-led sessions and interactive discussions that allowed participants to engage in peer learning. Key outcomes included practical tools for tax administration, strategies for improved tax incentive management, and a shared understanding of best practices.

As ECOWAS continues its efforts to transform tax administration across West Africa, the workshop marked a significant milestone in empowering Member States with the necessary tools and knowledge to drive sustainable economic growth through efficient tax systems.

Through collaborative efforts and a renewed focus on regional economic integration, ECOWAS is positioning West Africa to reap the benefits of more effective tax governance, ultimately creating a more robust financial landscape for the future.